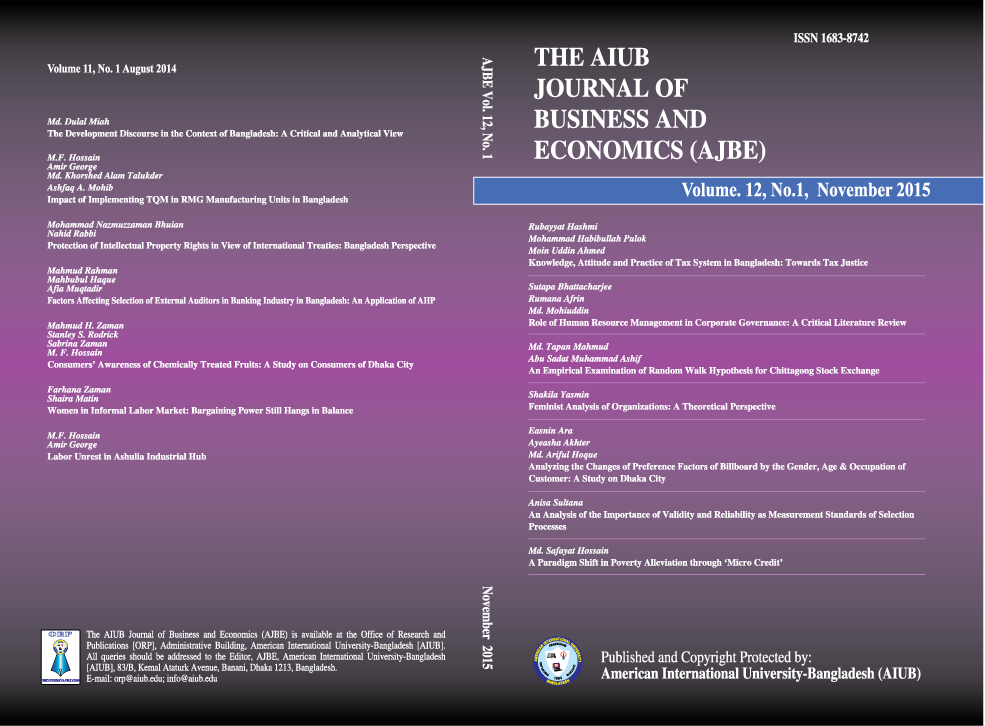

Knowledge, Attitude and Practice of Tax System in Bangladesh: Towards Tax Justice

Keywords:

Tax justice, VAT, Direct tax, KAP, Fairness, Equity, Luxury goodsAbstract

The baseline survey investigates the opinion of grass-root people about their understanding on knowledge, attitude and practice of tax system of Bangladesh. The general understanding of TAX and VAT is common for people but because of not taking VAT receipt VAT paid by the people might not go to state treasury. Study indicates that government should put high VAT on luxury goods and lower VAT on necessary goods rather than a uniform VAT system. In addition the government also should increase direct tax base so that deadweight loss of the society is reduced.

Downloads

Published

2015-11-30

How to Cite

Hashmi, R., Pulok, M. H., & Ahmed, M. U. (2015). Knowledge, Attitude and Practice of Tax System in Bangladesh: Towards Tax Justice. AIUB Journal of Business and Economics, 12(1), 01–20. Retrieved from https://ajbe.aiub.edu/index.php/ajbe/article/view/71

Issue

Section

Articles